How Is Periodic Interest Determined for Outstanding Liabilities

523 504 Noncurrent unearned government incentives. 857 Total equity.

Operating lease liabilities 379 375 Other accrued liabilities 3195 2405 Total current liabilities.

. All three sub-types of IRRBB potentially change the pricevalue or earningscosts of interest rate-sensitive assets liabilities andor off-balance sheet items in a way or at a time that can adversely affect a banks financial condition. Recording of certificate by cooperative. Click on row 2.

Liabilities and equity Accounts payable and accrued expenses 5470 5325 Current debt. Click the Calculate button. Provide taxpayers with current percentage amounts and interest rates.

Separate titles and taxation. 9725 8640 Redeemable noncontrolling interest. 1 Gap risk arises from the term structure of banking book instruments and describes the risk arising from the timing of instruments rate.

A In a cooperative a unit owners interest in a unit and its allocated interests is a real property interest for all purposes except that the real property constituting the cooperative shall be taxed and assessed as a whole and a unit owners interest shall not be. Penalties and interest continue to accrue on unpaid liabilities. Conveyance of interest in cooperative.

924 944 Total current liabilities. 767 808 Other noncurrent liabilities. The 1st payment is received on time.

This payment is required in addition to the. 6512 6424 Long-term debt. If taxpayers request further information regarding penalties and interest IRM 201 Penalty Handbook provides rates for IRC 6651a1 failure to file and IRC 6651 a2 failure to pay additions to tax.

Because we calculated the payment amount assuming 24 payments we need to edit row 2. When submitting a periodic payment offer the taxpayer must include the first proposed installment payment along with the Form 656. 6904 6621 Noncurrent operating lease liabilities.

The following SERP website provides. 10 9 10. Calculating the periodic payment.

The expected periodic payment is 23091. Periodic Payment Offer - An offer is called a periodic payment offer under the tax law if its payable in 6 or more monthly installments and within 24 months after the offer is accepted. 118 155 Other current liabilities.

Now we can start recording payments as they are received. 5298 5179 Long-term debt 5537 4914 Long-term operating lease liabilities 2151 2278 Other noncurrent liabilities 2037 1448 Total noncurrent liabilities.

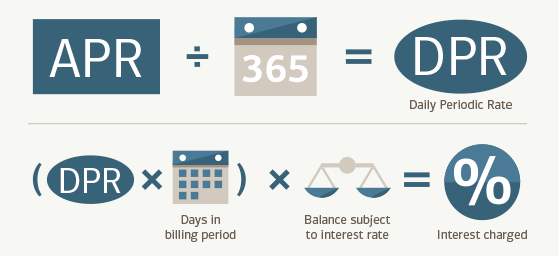

What Is An Apr By Better Money Habits Article Khan Academy

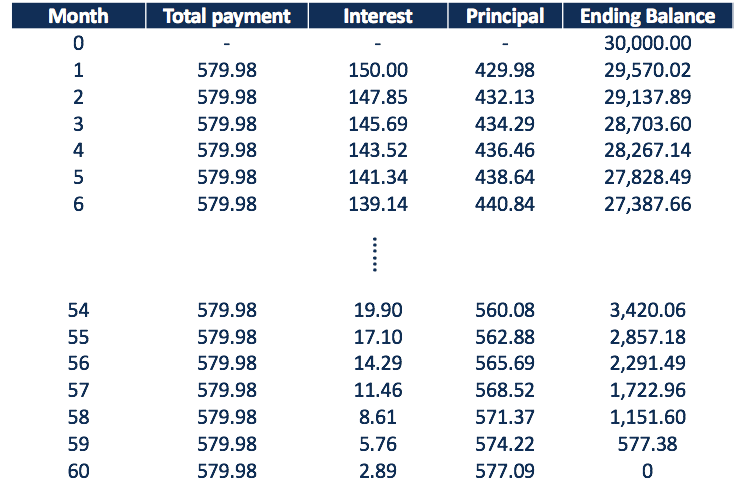

Amortization Schedule Overview Example Methods

Effective Annual Rate Formula Calculator Examples Excel Template

What Are The Causes Of A Bad Credit Rating Bad Credit Financial Management Boost Credit Score

:max_bytes(150000):strip_icc()/dotdash_Final_Amortized_Loan_Oct_2020-01-3a606fa9285943098248ac92e8d03b40.jpg)

Comments

Post a Comment